unified estate and gift tax credit 2021

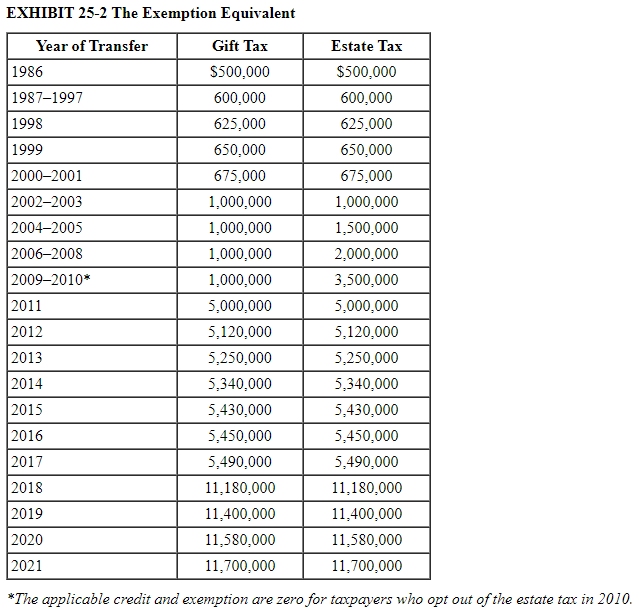

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. In other words in.

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Or of course you can use the unified tax credit to do a little bit of both.

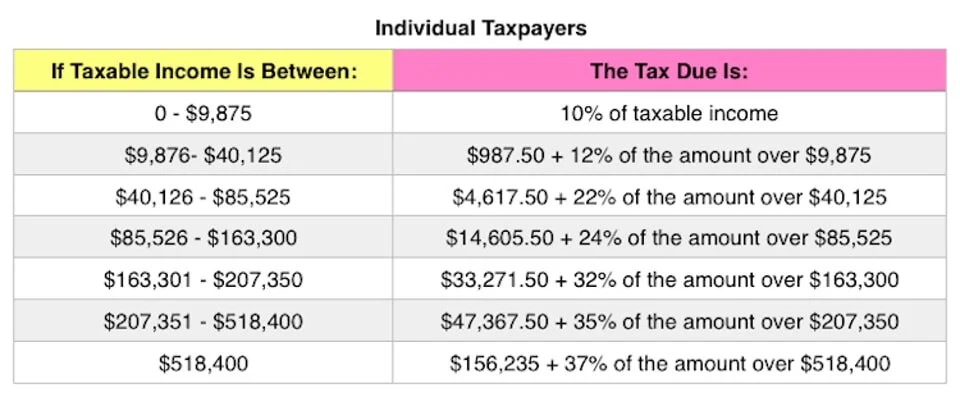

. 2021 4 Federal Credit Application. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death. The tax is then reduced by the available unified credit.

If a tax on a gift has been paid under chapter 12 sec. The unified tax credit changes regularly depending on. The unified tax credit changes regularly depending on.

California does not levy a gift tax. The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million on January 1 2026. Or of course you can use the unified tax credit to do a little bit of both.

The gift and estate tax. As of 2021 you are able to give 15000 per year to any. The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021.

Annual Exclusion for Gifts. Unified Estate And Gift Tax. For US citizens and residents a unified estate and gift tax is imposed generally based on the net.

What Is the Unified Tax Credit Amount for 2021. What Is the Unified Tax Credit Amount for 2021. What Is Unified Credit for 2021.

15000 per person per person. Any tax due is. 5 You can give up to this amount in money or property to any individual per.

The unified tax credit changes regularly depending on regulations related to estate and gift taxes. Tax generally is imposed by the local governments at various rates. What Is the Unified Tax Credit Amount for 2022.

Currently you can give any number of people up to 16000 each in a single year without incurring a taxable gift 32000 for spouses splitting giftsup from 15000 for. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021. Most relatively simple estates cash publicly traded securities small.

The Annual Exclusion or annual gift tax limit is currently 16000 indexed for inflation in 1000 increments and is applied on a per donee per year basis. Fortunately the estate tax credit creates an amount you can pass on to your heirs without being taxed. The Internal Revenue Service announced today the official estate and gift tax limits for 2021.

2021 Attachment 40 4 Tax Credit Application with Tax-Exempt Bond Financing - Updated April 29 2021. However the federal gift tax does still apply to residents of California. The unified aspect of this tax credit is that gift and estate taxes are rolled into one system to reduce your overall tax bill.

Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special. No California estate tax means you get to keep more of your inheritance.

Gifting Time To Accelerate Plans Evercore

Is That Gift Taxable Irs Form 709 John R Dundon Ii Enrolled Agent

3 12 263 Estate And Gift Tax Returns Internal Revenue Service

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

The Evolution Of Our Unified Estate And Gift Tax System

U S Estate Tax For Canadians Manulife Investment Management

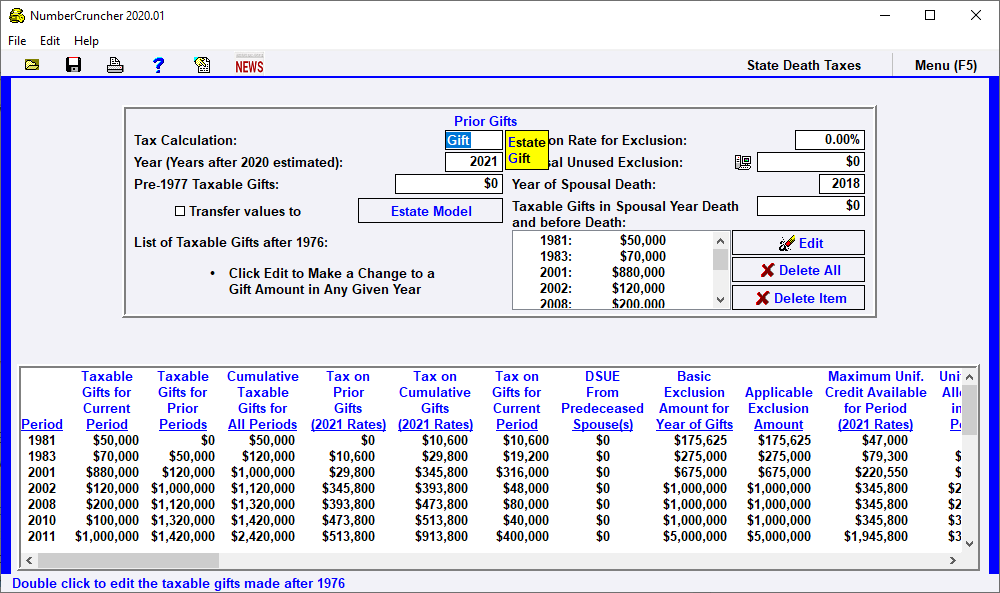

Prior Gifts Leimberg Leclair Lackner Inc

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

Federal Estate Gift Taxes Code Regs Including Related Income Tax Provisions As Of March 2021 Wolters Kluwer

Gift Tax Does This Exist At The State Level In New York

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Irs Increases 2020 Estate Tax Exemption Postic Bates P C

Navigating The Changes To Tax Laws In 2021 University Of Cincinnati

Solved For All Requirements Enter Your Answers In Dollars Chegg Com

Is There A Federal Inheritance Tax Legalzoom

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-12-13at8.54.47AM-3c2394da9dfc4e55b60cf32af792965e.png)